根據摩根士丹利分析師,儘管第四季表現不佳,但大型科技股的估值已低於去年,為投資者提供了良好的進場時機。

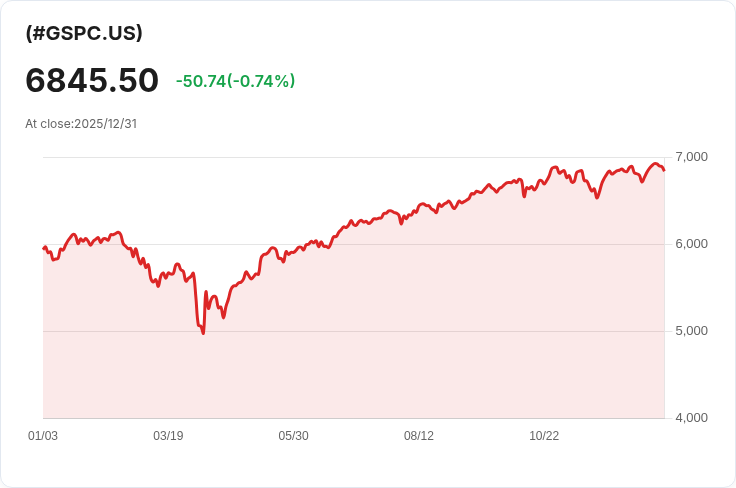

隨著2026年的到來,大型科技股在經歷第四季度的疲軟後,預示著未來將有反彈潛力。摩根士丹利投資管理高階投資組合經理安德魯·斯利門指出,目前被稱為“Mag 7”的七大科技股(包括GOOGL、AMZN、META等)其交易倍數均低於去年的水平,而這並未影響其基本面表現。他在接受CNBC訪問時表示,當前市場上出現的弱勢股價與強勁的業績之間存在脫節,形成了一個吸引投資者的入場點。

斯利門強調,第四季度科技股的下滑主要是由市場動態所驅動,而非企業業務表現惡化。此外,他提及目前對週期性行業的轉向符合美聯儲預期降息的傳統模式,但許多工業股已經提前消化了這一因素,面臨更大的估值壓力。

他同時指出,金融股作為例外,雖然該板塊表現強勁,但仍以約30%的市盈率折扣於整體市場,原因源自2008年金融危機的持續擔憂。斯利門認為,隨著監管政策的變化,資本釋放將推動盈利增長。

最後,對於AI投資帶來的巨額資金需求,斯利門承認可能造成流動性壓力,但他並不認為這會對2026年構成實質負面影響,展望未來,他對市場保持謹慎樂觀。

點擊下方連結,開啟「美股K線APP」,獲得更多美股即時資訊喔!

https://www.cmoney.tw/r/56/9hlg37